The Insurance Eligibility Verification Process: A Complete Guide

Learn about the insurance eligibility verification process, its importance, steps, and best practices to prevent claim denials and ensure smooth healthcare billing.

In the fast-paced world of healthcare, verifying a patient’s insurance eligibility isn’t just an administrative task—it’s a crucial step that ensures a seamless experience for both providers and patients. The insurance eligibility verification process helps healthcare providers confirm whether a patient’s insurance is active and what medical services are covered before treatment is provided.

Without proper verification, claim denials, billing errors, and unexpected out-of-pocket expenses can create unnecessary stress. This guide breaks down the process, its importance, challenges, and best practices to ensure smooth and hassle-free transactions.

What is the Insurance Eligibility Verification Process?

The insurance eligibility verification process is the method used by healthcare providers to confirm a patient’s insurance details before offering medical services. This step ensures that the patient has active coverage and clarifies co-pays, deductibles, and policy limitations. By verifying insurance beforehand, providers can reduce claim rejections, avoid billing disputes, and enhance overall patient satisfaction.

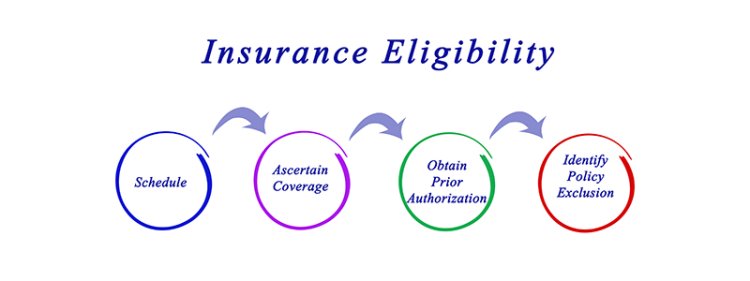

Steps in the Insurance Eligibility Verification Process

To make sure everything runs smoothly, the verification process typically involves these key steps:

1. Collecting Patient Information

The first step is gathering essential patient details, including:

-

Full name

-

Date of birth

-

Insurance provider name

-

Policy number or member ID

-

Contact details

Even a small error in this information can cause claim denials or delays, making accuracy crucial.

2. Contacting the Insurance Provider

Once the patient’s information is collected, the next step is reaching out to the insurance company to confirm the policy’s status. This can be done via:

-

Online portals – Many insurance companies offer real-time verification through their websites.

-

Phone calls – A direct call to the insurer can help clarify doubts and confirm specific coverage details.

-

Electronic Data Interchange (EDI) – This automated system helps providers check eligibility quickly and efficiently.

3. Checking Coverage and Benefits

After confirming active insurance, providers must review what’s covered under the plan. Key factors to verify include:

-

Deductibles and out-of-pocket expenses

-

Co-pays and co-insurance amounts

-

Policy exclusions or limitations

-

Prior authorization requirements for specific treatments

4. Verifying Network Status

Not all insurance plans cover services at all providers. Being in-network means lower costs for the patient, while out-of-network services can lead to higher expenses or claim denials. Verifying network status helps both the provider and patient avoid surprises.

5. Documenting Verification Details

Every step of the verification process should be recorded in the patient’s file, ensuring that there’s a clear reference for future billing and claims processing.

Why the Insurance Eligibility Verification Process is Important

Skipping the insurance eligibility verification process can result in significant issues. Here’s why this step is essential:

1. Reduces Claim Denials

One of the biggest reasons claims get denied is incorrect or outdated insurance information. Verifying eligibility before treatment helps avoid these costly mistakes.

2. Prevents Billing Errors

Patients often assume their insurance will cover specific services, only to receive unexpected bills later. Proper verification ensures transparency and avoids billing disputes.

3. Saves Time and Resources

Processing denied claims or correcting billing errors takes up valuable administrative time. A smooth verification process reduces these inefficiencies, allowing providers to focus on patient care.

4. Improves Patient Satisfaction

No one likes unexpected medical expenses. When patients understand their coverage beforehand, they can make informed decisions, leading to a better healthcare experience.

Common Challenges in the Insurance Eligibility Verification Process

Despite its importance, the insurance eligibility verification process comes with its own set of challenges:

1. Missing or Incorrect Patient Information

Even small errors, like a typo in a name or an incorrect policy number, can lead to claim denials. Double-checking details upfront is essential.

2. Delays from Insurance Providers

Some insurers take time to confirm policy details, especially during peak hours. Automated verification tools can help speed up this process.

3. Frequent Policy Changes

Patients may not always be aware of updates to their insurance plans, including changes in deductibles or covered services. Regular verification ensures providers work with the latest policy information.

4. Manual Verification Errors

If a provider relies on outdated information or manual processes, mistakes can happen. Automation can minimize these errors and improve efficiency.

Best Practices for a Smooth Insurance Eligibility Verification Process

To overcome these challenges, here are some proven strategies for streamlining the verification process:

1. Automate When Possible

Using electronic verification tools reduces errors and speeds up the process. Many modern healthcare systems integrate eligibility verification with electronic health records (EHRs) for real-time checks.

2. Verify Coverage Before Every Visit

Even if a patient has been seen before, their insurance status may have changed. Always verify coverage before each appointment to prevent issues.

3. Train Staff Regularly

Insurance policies, coverage details, and verification systems change frequently. Keeping your administrative team well-trained ensures they stay updated with the latest verification protocols.

4. Maintain Open Communication with Patients

Educating patients about their coverage helps prevent confusion. Inform them about co-pays, deductibles, and policy limitations before they receive services.

Final Thoughts

The insurance eligibility verification process plays a critical role in ensuring a smooth and efficient healthcare experience for both providers and patients. By verifying insurance details upfront, healthcare providers can reduce claim denials, prevent billing disputes, and enhance patient trust.

Implementing automated systems, training staff, and maintaining clear communication with insurance providers and patients can make this process seamless. Ultimately, an efficient verification process leads to fewer financial surprises and a better overall healthcare experience.

By prioritizing eligibility verification, providers can focus on what truly matters—delivering high-quality patient care without administrative headaches.

What's Your Reaction?