Loan Management Software: Features, Benefits, and Market Trends

Loan Management Software is a digital platform designed to automate and optimize loan processing. It enables financial institutions to track and manage loans efficiently while reducing manual errors and improving customer experience.

Introduction

In today’s fast-paced financial environment, Loan Management Software (LMS) has become an essential tool for banks, credit unions, and lending institutions. This software streamlines the entire loan lifecycle, from origination to disbursement, repayment, and collections. With digital transformation taking center stage, lenders are adopting LMS solutions to enhance efficiency, minimize risks, and ensure regulatory compliance.

What is Loan Management Software?

Loan Management Software is a digital platform designed to automate and optimize loan processing. It enables financial institutions to track and manage loans efficiently while reducing manual errors and improving customer experience. LMS solutions cater to various types of lending, including personal loans, business loans, mortgages, and microfinance.

Key Features of Loan Management Software

-

Loan Origination System (LOS) – Automates loan applications, underwriting, and approval processes.

-

Credit Risk Assessment – Integrates credit scoring tools to assess borrower risk.

-

Automated Payment Processing – Supports multiple payment methods and auto-debits.

-

Regulatory Compliance Management – Ensures adherence to financial regulations and reporting standards.

-

Customer Relationship Management (CRM) – Enhances borrower interactions through personalized communication.

-

Data Security & Fraud Prevention – Implements encryption and fraud detection mechanisms.

-

Analytics & Reporting – Generates insights on loan performance, default rates, and profitability.

-

Cloud-Based Integration – Offers remote accessibility and scalability for lenders of all sizes.

Benefits of Using Loan Management Software

-

Increased Efficiency – Reduces paperwork and automates repetitive tasks.

-

Enhanced Accuracy – Minimizes human errors in loan processing and compliance.

-

Better Risk Management – Improves decision-making with data-driven insights.

-

Cost Savings – Lowers operational costs by reducing manual labor and errors.

-

Improved Borrower Experience – Provides a seamless digital lending experience.

Market Trends in Loan Management Software

-

AI and Machine Learning Integration – LMS platforms are leveraging AI to predict default risks and optimize lending decisions.

-

Blockchain for Secure Transactions – Blockchain technology is enhancing security and transparency in loan processing.

-

Embedded Finance and APIs – LMS solutions are integrating with third-party platforms to offer embedded lending.

-

Cloud-Based LMS Adoption – More financial institutions are migrating to cloud-based loan management for scalability and remote accessibility.

-

RegTech for Compliance Automation – Regulatory technology (RegTech) is streamlining compliance reporting and fraud detection.

Leading Loan Management Software Providers

-

FIS Loan Management System

-

TurnKey Lender

-

Temenos Loan Origination

-

Finflux Loan Management

-

Oracle Lending and Leasing

Future Outlook

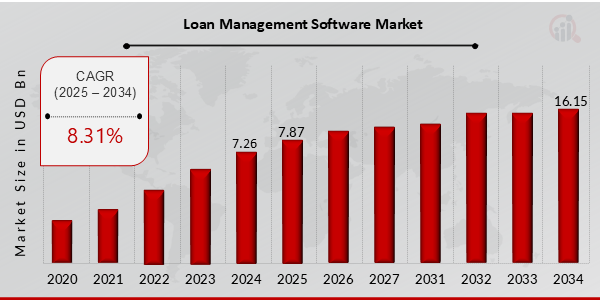

The loan management software market is expected to grow significantly as financial institutions continue to embrace digital transformation. AI-driven automation, blockchain technology, and cloud solutions will further enhance the capabilities of LMS platforms. With the increasing demand for streamlined loan processing and risk management, LMS adoption is set to become a crucial part of the lending ecosystem.

Conclusion

Loan Management Software is revolutionizing the lending industry by automating processes, reducing risks, and improving borrower experiences. As technology evolves, financial institutions must invest in advanced LMS solutions to stay competitive and meet the growing demands of the digital economy.

What's Your Reaction?