Are MFDs Using Mutual Fund Software Better Than Those Who Don't?

From portfolio management to risk analysis, investors seek MFDs who can provide seamless and efficient solutions. However, many MFDs still operate without mutual fund software, making it difficult for investors to decide who to choose.

Investors today prefer Mutual Fund Distributors (MFDs) who are all-rounders, offering a wide range of financial services under one roof. From portfolio management to risk analysis, investors seek MFDs who can provide seamless and efficient solutions. However, many MFDs still operate without mutual fund software, making it difficult for investors to decide who to choose.

What Is This Software?

A portfolio management software is a digital tool that helps MFDs manage their business more efficiently. It automates portfolio tracking, transaction processing, risk profiling, and client communication. This technology enables MFDs to offer better services, improve client engagement, and save time on manual tasks.

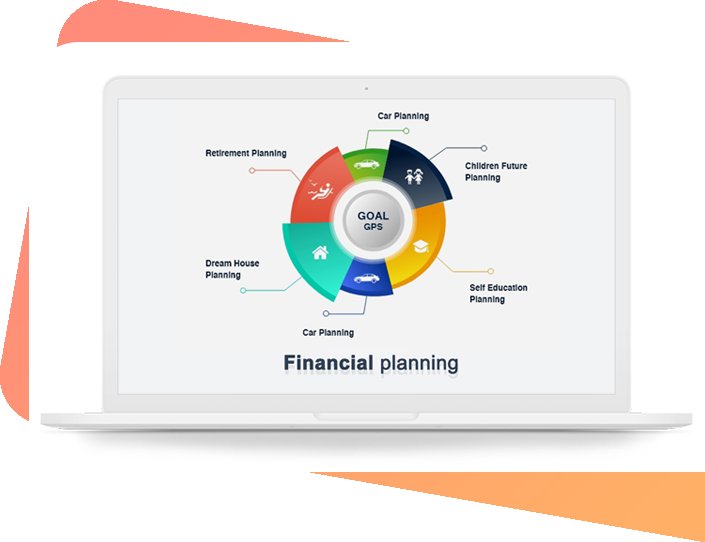

With digital transformation shaping the financial industry, software solutions have become a necessity rather than a luxury. Not only does it enhance operational efficiency, but it also helps MFDs maintain compliance with regulatory requirements. The right software can offer features such as goal-based planning, automated reminders, online transactions, and multi-asset reporting, making investment management seamless for both MFDs and their clients.

MFDs Using Software vs. Those Who Don’t

1. Efficiency and Time Management

● With Software: MFDs can automate investment tracking, generate reports instantly, and provide real-time insights to clients. Portfolio rebalancing and investment recommendations can be made quickly with AI-driven tools.

● Without Software: MFDs have to manually track portfolios, which is time-consuming and prone to errors. Managing multiple clients becomes a challenge, leading to inefficiencies in operations.

2. Client Engagement & Communication

● With Software: Automated alerts, reminders, and customized reports help MFDs maintain consistent communication with clients. Clients receive timely updates on market changes, portfolio performance, and new investment opportunities.

● Without Software: Client engagement becomes irregular, leading to poor investor retention. Clients may feel neglected and may switch to tech-enabled MFDs offering better service.

3. Accuracy and Risk Analysis

● With Software: Advanced risk-profiling tools help assess and minimize investment risks effectively. Market trends and risk appetite can be analyzed using AI and data-driven insights, ensuring better investment decisions.

● Without Software: MFDs rely on manual calculations, increasing the chances of errors. Risk assessment is often subjective, leading to potential miscalculations and investor dissatisfaction.

4. Compliance and Regulation

● With Software: Regulatory compliance is automated, ensuring smooth operations without penalties. KYC, AML, and SEBI guidelines can be integrated into the software, reducing compliance burdens on MFDs.

● Without Software: Keeping up with regulatory changes manually is challenging and increases non-compliance risks. A single compliance error can lead to legal complications and loss of investor trust.

5. Scalability and Business Growth

● With Software: MFDs with mutual fund software for IFA like that offered by REDVision Technologies can manage more clients effortlessly, leading to business expansion. With cloud-based solutions, scalability is seamless, allowing MFDs to serve a larger investor base without operational stress.

● Without Software: Managing multiple clients manually limits business growth and efficiency. Expansion becomes difficult as operational overheads increase with a growing client base.

6. Investment Transparency & Trust

● With Software: Clients have real-time access to their portfolios, transaction history, and reports, fostering trust and transparency. Investors appreciate the ease of monitoring their investments online.

● Without Software: Clients rely on periodic manual reports, which may not be up-to-date. This lack of transparency can lead to trust issues and lower client satisfaction.

What To Choose?

For MFDs looking to grow and build long-term investor trust, software is the way forward. The financial landscape is rapidly changing, and digital solutions are essential to stay competitive. Software-enabled MFDs are not just service providers; they act as trusted financial advisors who leverage technology to deliver better investment solutions. By using software, MFDs can streamline their operations, reduce manual errors, and improve client satisfaction, ultimately leading to higher investor retention and business growth.

Investors, on the other hand, should prefer MFDs who use technology-driven solutions. A tech-enabled MFD can provide faster services, accurate insights, and a seamless investment experience. Digital tools allow investors to track their portfolios in real-time, receive personalized investment advice, and stay updated on market trends. When choosing an MFD, investors should ask whether they use wealth management software and how it benefits their financial planning. An MFD with advanced software is more likely to offer a well-structured, data-driven, and transparent investment approach, ensuring better financial outcomes for investors.

For MFDs looking to grow and build long-term investor trust, software is the way forward. The financial landscape is rapidly changing, and digital solutions are essential to stay competitive. Software-enabled MFDs are not just service providers; they act as trusted financial advisors who leverage technology to deliver better investment solutions.

Conclusion

The debate is clear—MFDs using software are far ahead in terms of efficiency, accuracy, and client satisfaction. In an era where digital transformation is shaping the financial world, relying on manual processes is no longer an option.

What's Your Reaction?